One of the hottest trends in the Master Data Management (MDM) world today is how to exploit Artificial Intelligence (AI) and ignite that with Machine Learning (ML).

This aspiration is not new. It has been something that have been going on for years and you may argue about when computerized decision support and automation goes from being applying advanced algorithms to being AI. However, the AI and ML theme is getting traction today as part of digital transformation and whatever we call it, there are substantial business outcomes to pursue.

As told in the post Machine Learning, Artificial Intelligence and Data Quality perhaps all use cases for applying AI is dependent on data quality and MDM is playing a crucial role in sustaining data quality efforts.

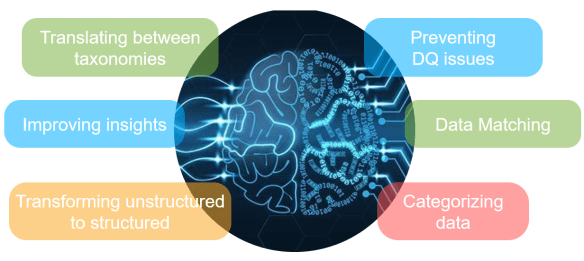

Here are six use cases that are commonly being addressed by AI and ML capabilities:

- Translating between taxonomies: As reported in the post Artificial Intelligence (AI) and Multienterprise MDM emerging technologies can help in translating between the taxonomies in use when digital transformation sets a new bar for utilizing master data in business ecosystems.

- Transforming unstructured to structured: A lot of data is kept in an unstructured way and to in order to systematically exploit these data in AI supported business process we need make data more structured. AI and ML can help with that too.

- Data quality issue prevention: Simple rules for checking integrity and validating data is good – but unfortunately not good enough for ensuring data quality. AI is a way to exploit statistical methods and complex relationships.

- Categorizing data: Digital transformation, spiced up with increasing compliance requirements, has made data categorization a must and AI and ML can be an effective way to solve this task that usually is not possible for humans to cover across an enterprise.

- Data matching: Establishing a link between multiple descriptions of the same real-world entity across an enterprise and out to third party reference data has always been a pain. AI and ML can help as examined in the post The Art in Data Matching.

- Improving insight: The scope of MDM can be enlarged to Extended MDM Platforms where other data as transactions and big data is used to build a 360-degree view of the master data entities. AI and ML is a prerequisite to do that.