Today’s guest blog post is from David Corrigan, CEO at AllSight

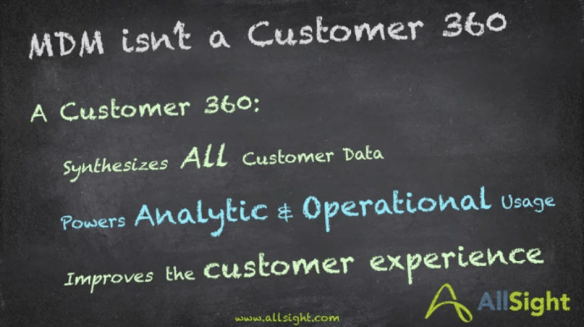

When Master Data Management (MDM) and Customer Data Integration (CDI) were designed over 15 years ago, they were touted as the answer to “Customer 360”. But the art of mastering data and the art of creating a complete view of a customer are two very different things. MDM is focused on managing a much smaller, core data set and aims to very deeply and truly master it. Customer 360 solutions focus on “all data about the customer” to get the complete picture. When it comes to a 360-degree view of the customer, master data is only part of the story. Additional data has to be part of the 360 in order to have a full understanding of the customer – whether that be an individual or an organization. Additional data sources and data types required for today’s Customer 360 include transactions, interactions, events, unstructured content, analytics and intelligence – all of which are not managed in MDM.

Today, leading organizations are looking beyond MDM to a new era of Customer 360 technology to deliver the elusive complete view of the customer. Here are 3 reasons why

- Customer 360 needs all data; MDM only stores partial data. MDM focuses on core master data attributes, matching data elements and improving data quality. Customer 360 has rapidly evolved requiring big data sets such as transactions and interactions, as well as unstructured big data like emails, call center transcriptions, and web chat interactions not to mention social media mentions, images and video.

- Customer 360 must serve analytical and operational needs; MDM only supports operational processing. The original intent of MDM was to provide ‘good’ data to CRM and transactional systems. While a branch of MDM evolved for ‘analytical MDM’ use cases, it was really a staging area for quality and governance to occur before data was loaded into warehouse for analysis and reporting. A Customer 360 is meant to be analyzed and used by marketing analysts, data scientists as well as customer care and sales staff – it powers many different personas with different perspectives of the customer.

- Customer 360 is about improving the customer experience; Master data (core data) is used during a customer experience. Master Data is required during a customer interaction to understand key facts about a customer including name, contact info, account info, etc. But the Customer 360 needs to blend all interactions, transactions and events into a comprehensive customer journey in order to analyze and personalize customer experiences.

But why does a Customer 360 now require all this information and capabilities beyond traditional MDM? It is because the expectations of customers and the demands they make on businesses have changed. Customers want personalized service and they want it now. And they want a consistent experience across all channels – online, via phone, and in store. They don’t want to have to repeat themselves or their preferences every time they interact with a business. This requires companies to know more about their customers and to anticipate their next move in order to retain their business and loyalty. Because, not only are customers more demanding than ever, but it is also easier for them to switch brands with little to no cost.

In order to meet these demands, many organizations assume they need to build these capabilities on their own using new technologies such as Apache Hadoop and Graph data stores. These technologies can join together silos of master data, transactional data, raw data lake data, and experience/journey analytics. However, a new class of software is emerging that bridges data, analytics and action and is based on these modern technologies. Customer Intelligence Platforms manage all customer information and synthesize it into an intelligent Customer 360. Synthesizing all of those data sources is no easy task and that is where many organizations stall out. What’s required is a machine-learning contextual matching engine that automates the process of linking customer data and evaluates data confidence.

Organizations such as Dell are seeing this shift first hand and have recognized that legacy MDM apps alone aren’t cutting it. Deotis Harris, Senior Director, MDM at Dell EMC said “We saw an opportunity to leverage AllSight’s modern technology (Customer Intelligence), coupled with our legacy systems such as Master Data Management (MDM), to provide the insight required to enable our sellers, marketers and customer service reps to create better experiences for our customers.”

If you are like Dell and so many other organizations, a Customer 360 is high on your priority list. A Customer Intelligence Platform might just be your next step.

For the second time this year there is a Gartner Magic Quadrant for Master Data Management Solutions out. The two leaders, Orchestra Networks and Informatica, have released their free copies

For the second time this year there is a Gartner Magic Quadrant for Master Data Management Solutions out. The two leaders, Orchestra Networks and Informatica, have released their free copies